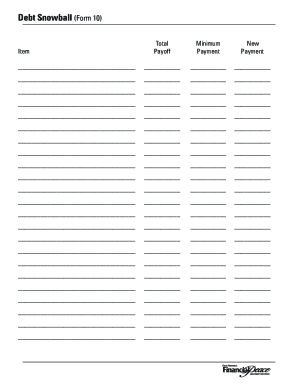

Get the free cash flow plan

Get, Create, Make and Sign dave ramsey monthly cash flow plan form

How to edit monthly cash flow plan template online

How to fill out monthly cash flow plan ramsey pdf form

How to fill out FPU Central Monthly Cash Flow Plan

Who needs FPU Central Monthly Cash Flow Plan?

Video instructions and help with filling out and completing cash flow plan

Instructions and Help about monthly cash plan

Welcome back to the wife mother teacher Channel um today I'm going to be showing you how we use the monthly cashflow plan form to fill out our monthly finances this form is actually part of Dave Ramsey's program and so if I flip this is our book from his Financial Peace University class which is wonderful if you have ever wanted to learn more about finances to get your finances in track I cannot recommend this enough I do think though that the document is also available in his book Total Money Makeover, so I will link both of those below so that you could find those on your own but basically what I do is I take that form I take it to the printer and I have it printed on large this is 11 and a half by 17 paper I like to have everything in one page, so that's why I've chosen this paper size so um I kind of want to show you how I fill out the form and use it which is slightly different from his recommended procedure I should say just as a disclaimer upfront I'm just an ordinary person I'm not an expert this is just how I have found his documents to be extremely helpful so to give you an example this is going to look different from his recommended way this is our form filled out from last month this would be from May and the first thing that I do that's not in his recommended list is up at the top I keep track of items that we are going to need to spend money on either this month or in the future so for example I knew that in May we are having our lawn mower serviced, so I needed to remember to include that, and I needed to buy monthly heartworm for my dogs, so those are two expenses that I just wanted to remember, so I wrote them up here, and I've also decided that for our health insurance in 2016 I would like to plan ahead and have saved our deductible ahead of time, so I am just including that in here as something to remember so every single month I'm going to write this note over again until we get to 2016, so that's the first thing that I do that's been really helpful the other thing that I do is I go through and if I have bills that are due on a certain date which let's face it most bills are I go ahead and put and here is the date of when they're due, and I find this to be really helpful when I go in, and I fill out the next form which I'll talk about in another video, but that's what these numbers represent, so these are auto insurance is due on the seventh of the month we have two separate life insurance, so those are due on the 24th and the 28th so it just kind of gives you an idea of one thing that you can do another thing that we do differently then Dave's recommended plan is I fill out boxes to represent areas I would like to spend money in or plan to spend money in or need to spend money in, but I'm not yet sure exactly how much I'm going to spend so for example in May we were wanting to spend some money on clothing now the fact that these boxes are empty tells me that we did not actually end up doing that but it just kind of lets me...

People Also Ask about monthly cash flow form

Is a written cash flow plan a budget?

What is a cash flow plan Dave Ramsey?

What is a written cash flow plan?

How often is a written cash flow plan done?

How do you create a cash flow budget?

What does a cash flow budget look like?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file cash flow plan?

What is the purpose of cash flow plan?

What is cash flow plan?

How to fill out cash flow plan?

What information must be reported on cash flow plan?

Where do I find dave ramsey monthly cash flow pdf?

Can I create an electronic signature for signing my tax income in Gmail?

How can I fill out dave ramsey monthly cash flow plan printable on an iOS device?

What is FPU Central Monthly Cash Flow Plan?

Who is required to file FPU Central Monthly Cash Flow Plan?

How to fill out FPU Central Monthly Cash Flow Plan?

What is the purpose of FPU Central Monthly Cash Flow Plan?

What information must be reported on FPU Central Monthly Cash Flow Plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.