Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file cash flow plan?

Generally, any individual, business, or organization that has a large amount of debt or is in need of cash flow financing must file a cash flow plan. This plan is typically required by creditors to prove that the party has the ability to repay the debt, and to provide guidance on how they will do so.

What is the purpose of cash flow plan?

A cash flow plan is a financial document that outlines the projected inflow and outflow of cash for a business over a certain period of time. It is a vital tool for businesses to assess their financial health and identify potential problems and opportunities. It can help businesses anticipate cash needs, manage budgeting and forecasting, and identify potential sources of financing.

When is the deadline to file cash flow plan in 2023?

The deadline to file a cash flow plan in 2023 will depend on the specific regulations of your jurisdiction. Generally, most cash flow plans are due at the end of the fiscal year or by a specific date set by the applicable government or other regulatory body.

What is the penalty for the late filing of cash flow plan?

The penalty for the late filing of a cash flow plan will depend on the specific regulations of the jurisdiction in which the business is located. Generally, late filings can result in fines, penalties, and other legal costs.

A cash flow plan is a financial management strategy that helps individuals or businesses to effectively manage and track their cash flow. It involves forecasting and managing the inflows and outflows of cash over a specific period of time, typically on a monthly or yearly basis.

A cash flow plan typically includes an analysis of expected income sources, such as wages, sales, or investments, and anticipated expenses, such as rent, utilities, loans, and other operational costs. By monitoring cash inflows and outflows, individuals or businesses can ensure that they have enough cash on hand to cover their expenses, meet financial obligations, and make informed decisions about saving, investing, or managing debt.

A cash flow plan can also help identify potential cash shortages or surpluses, allowing individuals or businesses to take proactive measures to address any financial gaps or capitalize on opportunities for growth. It is an important tool for budgeting, financial planning, and achieving financial stability and success.

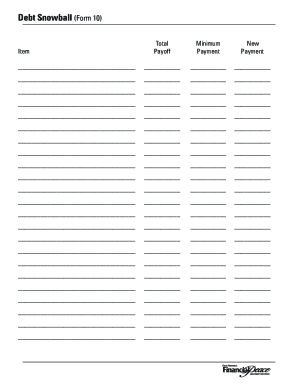

How to fill out cash flow plan?

Here are some steps to fill out a cash flow plan:

1. Identify your income sources: Start by listing all the different sources of income you have during a specific period, such as salaries, wages, rental income, business income, and any other money that comes in regularly.

2. Track your expenses: Make a comprehensive list of all your expenses, both fixed and variable. This includes monthly bills, loan payments, groceries, entertainment expenses, transportation costs, and any other regular or irregular expenses.

3. Categorize your expenses: Organize your expenses into categories such as housing, transportation, groceries, debt payments, utilities, entertainment, etc. This will help you get a clear picture of where your money is going.

4. Determine your cash flow: Calculate your total income and deduct your total expenses from it. This will give you a net cash flow figure. If your income is more than your expenses, you have a positive cash flow. If your expenses exceed your income, you have a negative cash flow.

5. Analyze your cash flow: Evaluate your cash flow and identify areas where you can potentially cut costs or increase your income. This analysis will help you identify areas of improvement and set financial goals.

6. Set financial goals: Based on the analysis of your cash flow, set specific financial goals such as saving a certain amount each month, paying off debt, or reducing certain expenses.

7. Create a budget: Use your cash flow plan to create a detailed budget that outlines your financial goals, income, expenses, and savings targets. It should also allocate funds for emergencies and unexpected expenses.

8. Monitor and review your cash flow plan regularly: Regularly review and update your cash flow plan to ensure it reflects any changes in your income or expenses. Monitor your progress towards your financial goals and make adjustments as needed.

Remember, a cash flow plan is a dynamic document that needs to be revisited regularly to ensure its accuracy and effectiveness in helping you manage your finances efficiently.

What information must be reported on cash flow plan?

The information that must be reported on a cash flow plan includes:

1. Cash inflows: This includes all the sources of cash for the business, such as sales revenue, loans, capital injections, and any other income generated by the business.

2. Cash outflows: This includes all the expenses and payments the business has to make, such as salaries, rent, utilities, materials, loan repayments, taxes, and any other costs incurred by the business.

3. Beginning and ending cash balances: The cash flow plan should provide the starting cash balance at the beginning of the reporting period and the projected ending cash balance at the end of the reporting period.

4. Operating activities: Cash flows related to the daily operations of the business, such as collections from customers, payments to suppliers, and other expenses related to the core operations.

5. Investing activities: Cash flows related to the acquisition or sale of long-term assets, such as property, plant, and equipment, as well as any investments made by the business.

6. Financing activities: Cash flows related to the issuance or repayment of debt, as well as any equity investments made in the business, such as loans, dividends, and capital contributions.

7. Net cash flow: The net cash flow is calculated by subtracting the total cash outflows from the total cash inflows, indicating the overall increase or decrease in cash during the reporting period.

8. Cash flow projections: The cash flow plan should also include projections for future cash flows, usually on a monthly or quarterly basis, to help the business anticipate and plan for its future cash needs and potential shortfalls.

9. Cash flow analysis: A thorough analysis of the cash flow trends, patterns, and potential risks should be included, highlighting any significant fluctuations or potential issues that could impact the business's cash position.

10. Supporting information: The cash flow plan should be supported by relevant financial statements, such as income statements, balance sheets, and financial ratios that provide additional context and information for the cash flow projections.

How can I send cash flow plan for eSignature?

Once your monthly cash flow form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the dave ramsey monthly cash flow plan electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your dave ramsey monthly cash flow plan pdf in minutes.

How do I edit monthly cash flow plan straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing dave ramsey monthly budget pdf form right away.